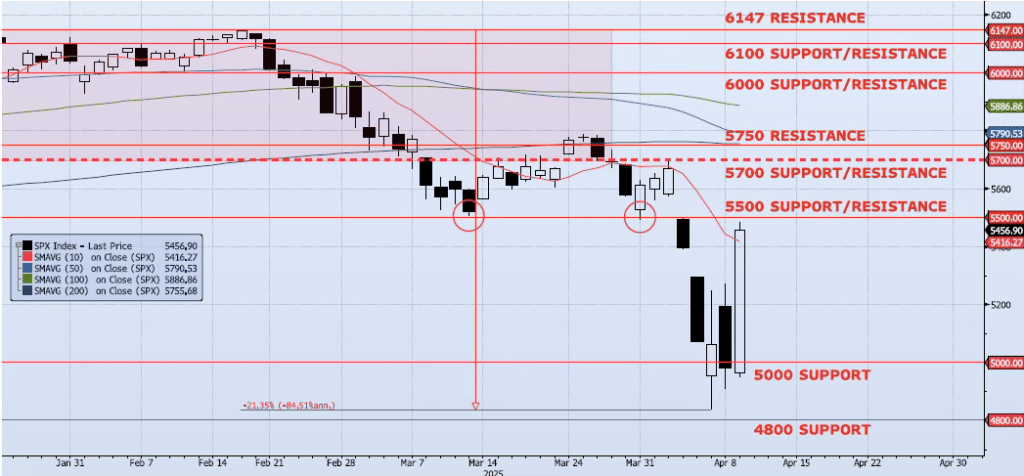

Current ICAP Momentum/Trend Model (MOTR) Signal: NEGATIVE (Day Count = 9)

The SPX index gained 9.52% on the day, closing at 5456. The index has now rallied over 13% trough-to-peak in just two sessions. Price action is manic with multiple 10% moves intraday over the past three sessions. Yesterday’s stick was a massive reversal which fell just shy of resistance at 5500. Momentum and trend indicators improved. Spot VIX settled down almost 50% below its recent peak (ref 60.13), closing at 33.62. The ICAP Momentum/Trend (MOTR) Model signal remains Negative. As I wrote in yesterday’s note, “I am conscious of aggressive, counter trend rallies and I am a seller, not a chaser. I remain focused on my additional downside targets for the entire move of 4800, 4200 and 3700. I am very confident that all three of these remaining downside targets will be achieved by the end of this process.” As of now nothing has changed.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5500: ~10% Move Peak-to-Trough

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

5790: 50dma

6000: Previous Support