Current ICAP Momentum/Trend Model (MOTR) Signal: NEUTRAL (Day Count = 5)

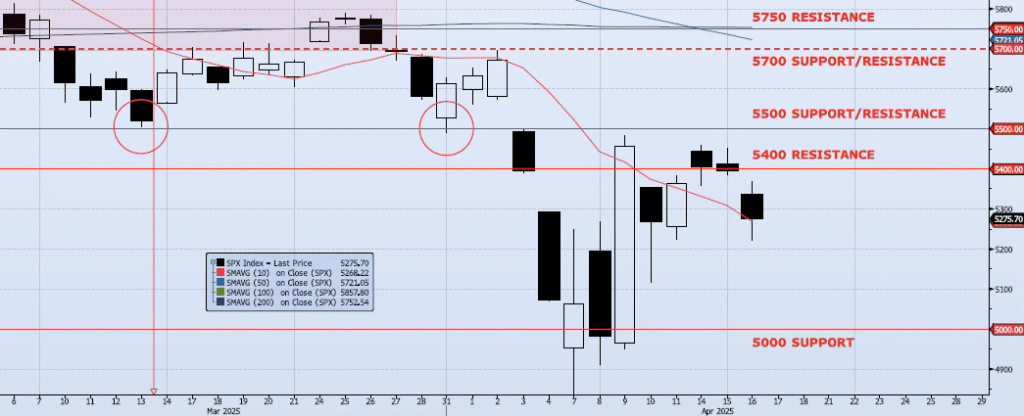

The SPX index fell 2.24% during yesterday’s session, closing at 5275. This close came well below the previously identified resistance level at 5400. In fact, as I wrote yesterday morning, “I would focus on the 5400 level (cash) and the 5364 level (front month futures – ESM5). Breaks below these levels should ignite some additional selling.” This is exactly what happened. The session low of 5220 matches the Apr 11 low and could act as near-term support, but I don’t think it will. My momentum and trend indicators are showing signs of stalling as Spot VIX and VIX term structure remain mixed. The ICAP Momentum/Trend (MOTR) Model signal remains Neutral. I will continue to be a seller of all counter trend rallies until I am proven wrong or my additional downside targets for the entire move of 4800, 4200 and 3700 are achieved. I was asked the other day, so I am opening up here, the net return for the ICAP portfolio 2025 YTD is currently 30.63%. Additionally, we are in the middle of a capital raise effort. The fund structure and name may be changing in the coming weeks. If and when, I will broadcast the changes widely.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close

5500: ~10% Move Peak-to-Trough

5700: Previous Support Sep/Nov

5721: 50dma

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support