Current ICAP Momentum/Trend Model (MOTR) Signal: NEUTRAL (Day Count = 6)

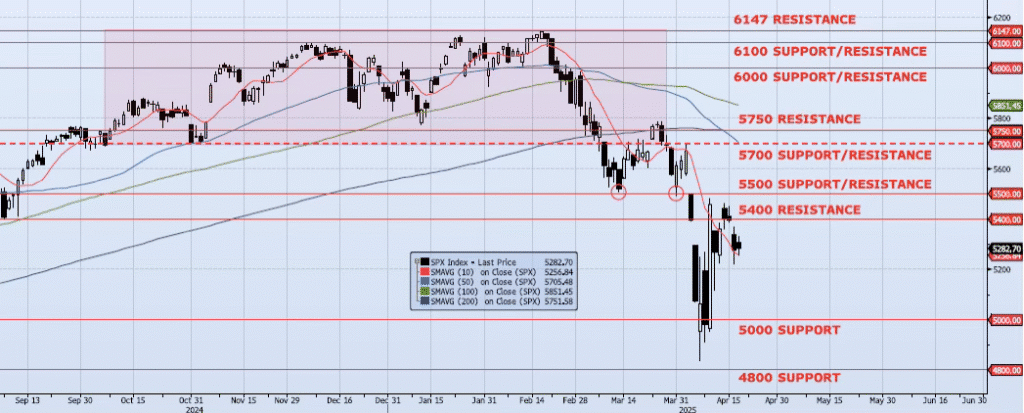

The SPX index gained just 13bps during Thursday’s session, closing at 5282. Price action overall was relatively subdued with the day’s low (ref 5255) falling right on the 10dma (ref 5256). As I mentioned last week, for the near term I am focused on resistance at 5400 (cash) and 5364 (front month futures – ESM5). The current set up leans towards those levels holding and renewed weakness developing. Momentum and trend are flat as Spot VIX and VIX term structure remain mixed. The ICAP Momentum/Trend (MOTR) Model signal remains Neutral. I remain a seller of any counter trend rallies with near term downside targets of 5000 and 4800. I continue to believe that my intermediate/longer term downside targets of 4200 and 3700 will be achieved before the current cycle ends.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close

5500: ~10% Move Peak-to-Trough

5700: Previous Support Sep/Nov

5705: 50dma

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support