Current ICAP Momentum/Trend Model (MOTR) Signal: NEGATIVE (Day Count = 2)

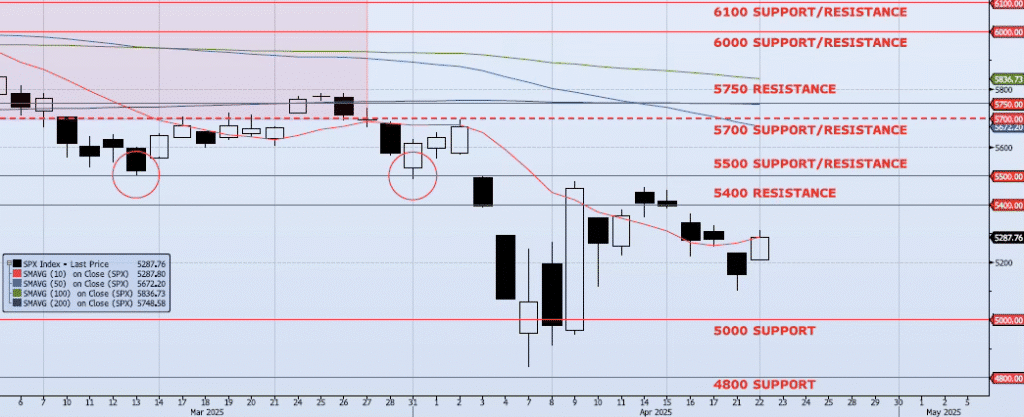

The SPX index gained 2.51% on the session yesterday, closing just below 5300 on the 10dma at 5287. The Apr 21 low (ref 5101) tested 5100 and represented a peak-to-trough, four day move lower of -6.55%. The aggressive bounce off the 5100 level has been impressive but has occurred with divergent momentum and trend as well as conflicting Spot VIX and VIX term structure signals. The ICAP Momentum/Trend (MOTR) Model signal remains Negative. All said, if the index can follow through and clear the 5300 level there may be some additional upside back to the 5400/5500 range. Strategically, I cleared most of my shorts during the Apr 21 sell-off and on stop during yesterday’s rally. As I have continued to write, “I remain a seller of any counter trend rallies with near term downside targets of 5000 and 4800. I continue to believe that my intermediate/longer term downside targets of 4200 and 3700 will be achieved before the current cycle ends.”

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close

5500: ~10% Move Peak-to-Trough

5672: 50dma

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support