Current ICAP Momentum/Trend Model (MOTR) Signal: POSITIVE (Day Count = 2)

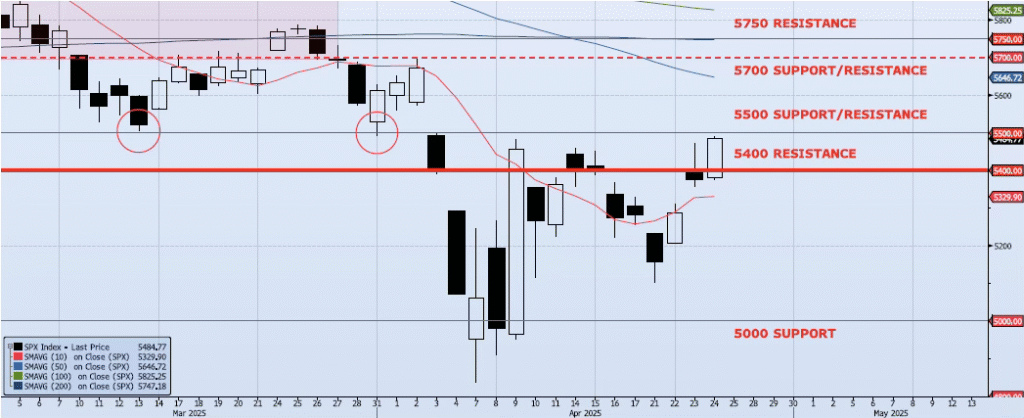

The SPX index gained 2.03% during yesterday’s session, closing well above 5400 at 5484. My momentum and trend indicators continued to improve as the index is now well within the 5400/5500 range which I referenced on Apr 23. This range should act as firm resistance, and we could see some consolidation here before a real move through 5500. My Spot VIX model is two weeks into a “risk on” signal and VIX term structure is now neutral. The ICAP Momentum/Trend (MOTR) Model signal remains Positive. All said, if internals can hold and the MOTR signal remains Positive, I could see this rally potentially testing 5700. I am watching carefully and am more than willing to wait for better entry points to re-establish my shorts. I continue to be a seller of these rallies, not a chaser as my overall view is still negative. I remain confident that the near-term downside targets of 5000 and 4800 will be achieved. I continue to believe that my intermediate/longer term downside targets of 4200 and 3700 will be achieved before the current cycle ends.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough

5646: 50dma

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support