Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 3)

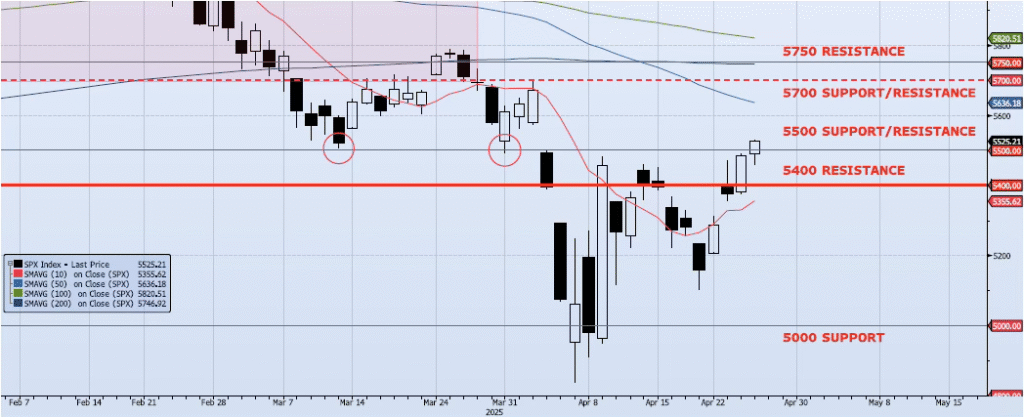

The SPX index gained 74bps during Friday’s session, closing at 5525. Momentum and trend indicators continue to improve as the index has now taken out resistance at 5500 and is filling the Apr2/Apr3 gap (Liberation Day+1). My Spot VIX model signal remains “risk on” and VIX term structure remains neutral. The ICAP Momentum/Trend Model signal remains Positive. As I wrote last week, “if internals can hold and the ICAP Model signal remains Positive, I could see this rally potentially testing 5700.” However, I believe the risk of a hard reversal back down outweighs any potential upside gain. With that, I am watching the ICAP Model signal and price action for better entry points to re-establish my shorts. As the cycle ends, and risk becomes balanced I will begin to take normal upside exposure. We are just not there yet. As I have continued to write, “I continue to be a seller of these rallies, not a chaser as my overall view is still negative. I remain confident that the near-term downside targets of 5000 and 4800 will be achieved. I continue to believe that my intermediate/longer term downside targets of 4200 and 3700 will be achieved before the current cycle ends.”

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5636: 50dma

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support