Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 4)

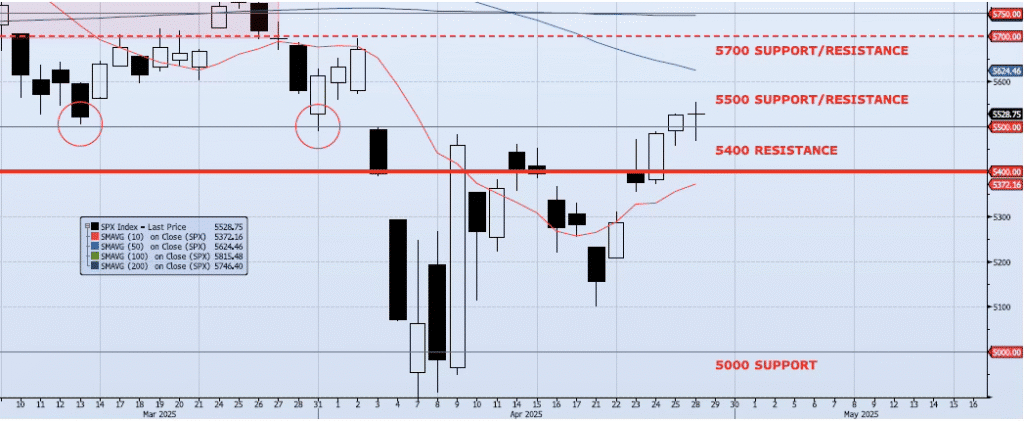

The SPX index was essentially flat on the session showing signs of indecision and whip through the day. The high/low range was 85 handles, but the open/close range was less than one. A wide range, push between buyers and sellers, but at the end of the day the index went nowhere. Momentum and trend indicators continued to improve. My Spot VIX model signal remains “risk on” and VIX term structure remains neutral. The ICAP Momentum/Trend Model signal remains Positive. The index has now rallied ~9% from the Apr 21 low. Although the index did break below 5500 during the session, it held this level on a closing basis. Overall, there remains additional short-term risk to the upside, but the greater intermediate term risk remains to the downside. I remain confident that the near-term downside targets of 5000 and 4800 will be achieved. I continue to believe that my intermediate/longer term downside targets of 4200 and 3700 will be achieved before the current cycle ends.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5624: 50dma

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support