Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 5)

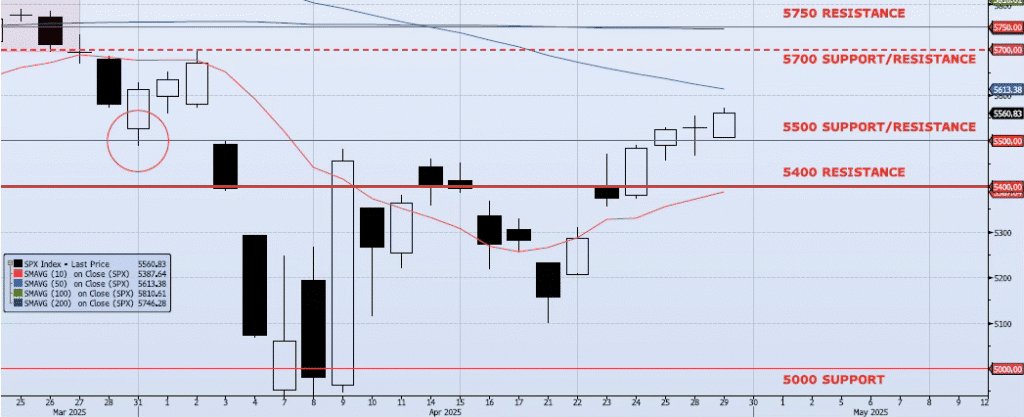

The SPX index gained 57bps yesterday, closing at 5560. The index hit a high of 5571 which marked an almost 10% rally off the Apr 21 low (ref 5101). More interestingly, 5571 also marked the index low on Apr 2 ahead of the post-close tariff announcements and melt down. My momentum and trend indicators continue to improve. My Spot VIX model signal remains “risk on” and VIX term structure remains neutral. The ICAP Momentum/Trend Model signal remains Positive. All said, I am impressed with the short-term bullish action and continue to believe that this counter trend rally could test 5700. Broader stroke, I continue to see risk as skewed to the downside with aggressive moves lower more likely than a true breakout higher from current levels. The ICAP model remains overall bearish (all periods considered) with downside targets of 5000, 4800, 4200 and 3700 still my base case before the current cycle ends.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5613: 50dma

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support