Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 6)

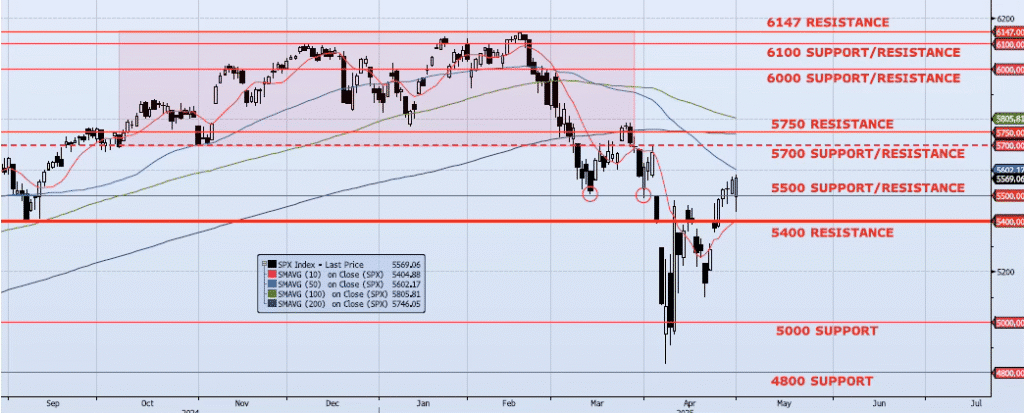

The SPX index gained 15bps yesterday, closing at 5569. What’s much more impressive than that is the index closing +2.50% above the early session low of 5433. The last trading day of April was emblematic of a month which saw a peak-to-trough drawdown of ~15% in just three days followed by a trough-to-peak rally of ~15% over the following three weeks. Momentum and trend continued to confirm this counter trend rally for the short term, but their magnitude of expansion is compressing (not a huge deal at the moment). My Spot VIX model signal remains “risk on” and VIX term structure remains neutral. The ICAP Momentum/Trend Model signal remains Positive. All in, as I have written over the past few days, “I continue to believe that this counter trend rally could test 5700.” Although the current move higher has been impressive, I am not chasing. I continue to see the greater risk as skewed to the downside and am managing the S&P 500 exposure in the portfolio short/flat with no long exposure until the intermediate and long-term signals shift from the current Negative reading.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5602: 50dma

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support