Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 7)

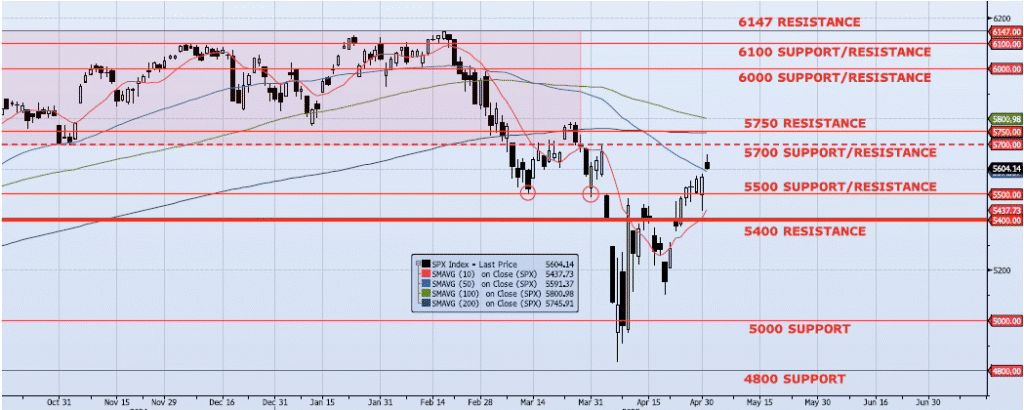

The SPX index gained 63bps on the session, closing at 5604. The index did hit a mid-morning high of 5658 but struggled to hold those gains into the close. That said, the index continued to grind higher and has now gapped above the 50dma (ref 5591), holding the 5600 level through the closing bell. Momentum and trend are slowing but remain constructive. My Spot VIX model signal remains “risk on” and VIX term structure remains neutral. The ICAP Momentum/Trend Model signal remains Positive. As I have written over the past few days, this counter trend rally could test 5700. All that said, I do not like the overall setup. In my opinion and work, the technical damage that has been done to the index suggests that the lows have not been achieved for the current cycle. I continue to see the greater risk as skewed to the downside.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5591: 50dma (BROKEN)

5700: Previous Support Sep/Nov

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support