Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 9)

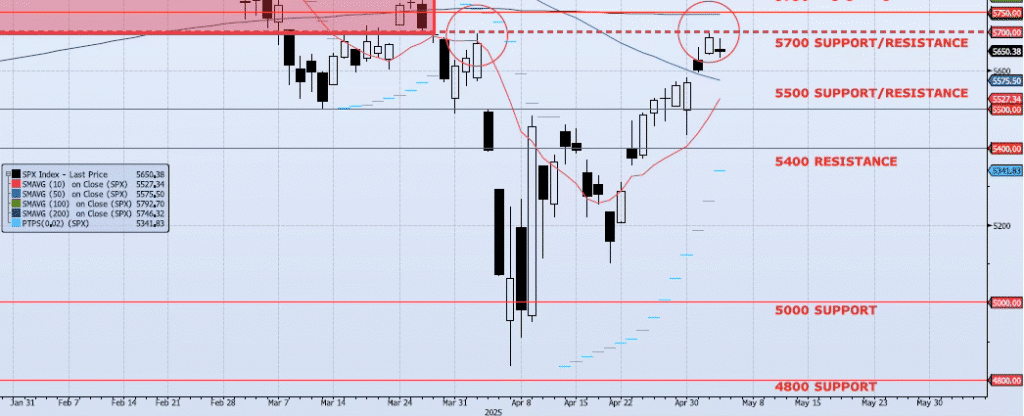

The SPX index fell 64bps yesterday, closing at 5650. Momentum and trend indicators while positive continue to fade. My spot VIX signal is “risk on” but will turn off over the next two sessions. My VIX term structure signal remains neutral. As I wrote yesterday, “The 5700 level represents the base of the topping formation which I identified back in January. This level should act as significant resistance and could potentially be an intermediate term high for the index. While the index could potentially break back above 5700, I think the greater probability trade is a reversal and fade back towards the 5000 level.” I continue to respect the potential for a continuation of this recent counter trend rally. That said, I am becoming convinced that the 5700 level will hold and that the index will resume the fade to lower lows.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5575: 50dma (BROKEN)

5700: Previous Support Sep/Nov (TESTED)

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support