Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 1)

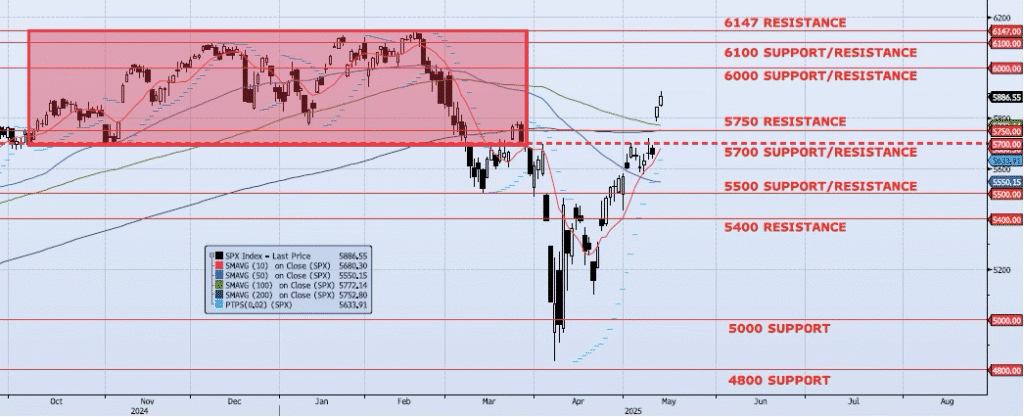

The SPX index gained 72bps on the session, closing at 5886. The index is now just ~4.50% from peak and has now rallied ~22% from the Apr 7 low (ref 4835). The index has also broken back into the previously identified “top” which formed from Oct24 to Mar25. Momentum and trend indicators continue to expand. My Spot VIX signal remains “flat”. My VIX term structure signal remains neutral. The ICAP Momentum/Trend Model signal has shifted from Neutral back to Positive. I have clearly been very bearish since late Dec24. That trade has worked extraordinarily well as the portfolio is currently up ~30% YTD having experienced no drawdown at all for the year. While I have been adamant that the lows for this cycle were not yet in place, the action over the past two weeks has created much more production than I expected. The ICAP model is now improving significantly on the intermediate and long-term runs (as well as the daily). With this, I am returning to “normalized” trade distribution for the portfolio meaning I will shift from running the book Short/Flat to running it Long/Short/Flat. I am skeptical, but I am happy to remain objective.

Note: I am in the process of changing fund structure and taking on additional capital. In the coming weeks Island Capital Investments LLC will become AscalonVI Capital LP. I will keep updates coming as far as official dates, email changes, website changes, etc. Thank you.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5550: 50dma (BROKEN)

5700: Previous Support Sep/Nov (BROKEN)

5750: 38.2% Retracement Peak-to-Trough (BROKEN)

6000: Previous Support