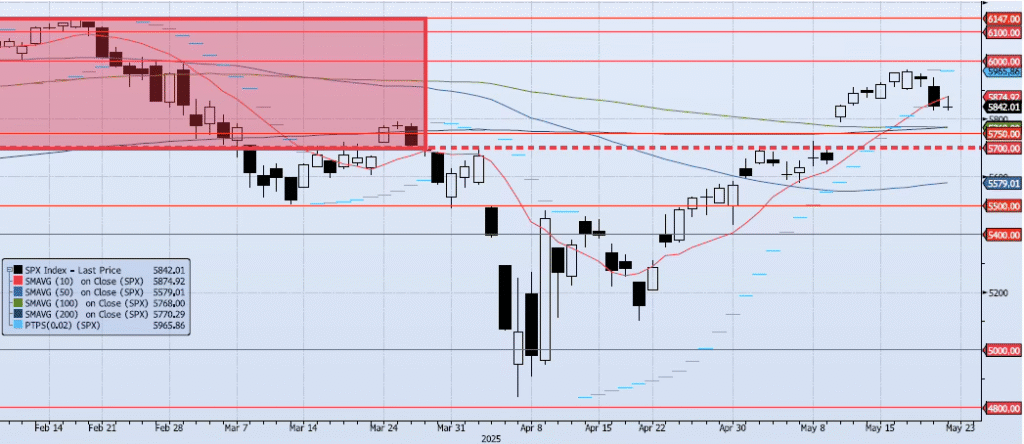

Current ACAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 5)

The SPX index was essentially flat on the day, closing at 5842. A late session run to the day’s high (ref 5878) was extremely short lived as the index reversed hard into the closing bell (red eye!!). Price action was truly indecisive with an open/close spread of less than one handle. Alarming, as the previous session was the weakest day since Apr 21. My momentum and trend indicators continue to degrade. My Spot VIX signal has shifted to “risk off”. My VIX term structure signal is neutral. The ACAP Momentum/Trend Model signal remains Neutral but is setting up for a potential shift to Negative over the coming days. I continue to see a growing risk of an extended move to the downside with 5786 (May 12 low) as a key level. A break below 5786 should produce an accelerated drawdown, filling the May 9/May 12 gap, and a test of 5700.

Trade Support:

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6000: Previous Support

6100: Previous Support

6147: All-Time High