Current ACAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 6)

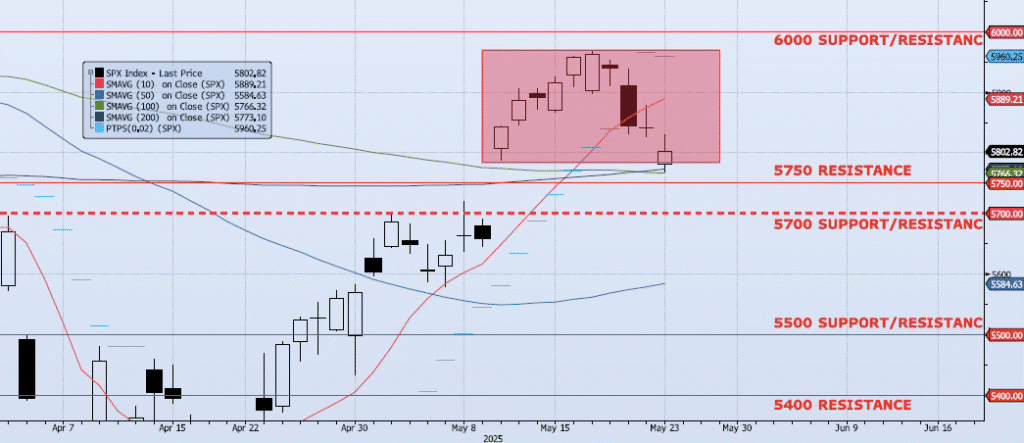

The SPX index fell 67bps during Friday’s session, closing at 5802. The index did hit a low of 5767 early in the session testing both the 200dma (ref 5773) and the 100dma (ref 5766). More importantly, the index broke the 5786 level which I have been focused on. This level represents the May 12 low and support for the May 9 / May 12 gap. This break was on an intra-day basis only, but suggests further weakness is likely in my opinion. The closing print came at an approximate mid-way point between this low and the session high (ref 5829). My momentum and trend indicators have continued to degrade over the past few sessions. My Spot VIX signal is “risk off”. My VIX term structure signal is neutral. The ACAP Momentum/Trend Model signal remains Neutral but is setting up for a potential shift to Negative over the coming days. As I wrote last week, “I continue to see a growing risk of an extended move to the downside with 5786 (May 12 low) as a key level. A break below 5786 should produce an accelerated drawdown, filling the May 9/May 12 gap, and a test of 5700.” Bottom line, this is becoming a very negative set up very quickly.

Trade Support:

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6000: Previous Support

6100: Previous Support

6147: All-Time High