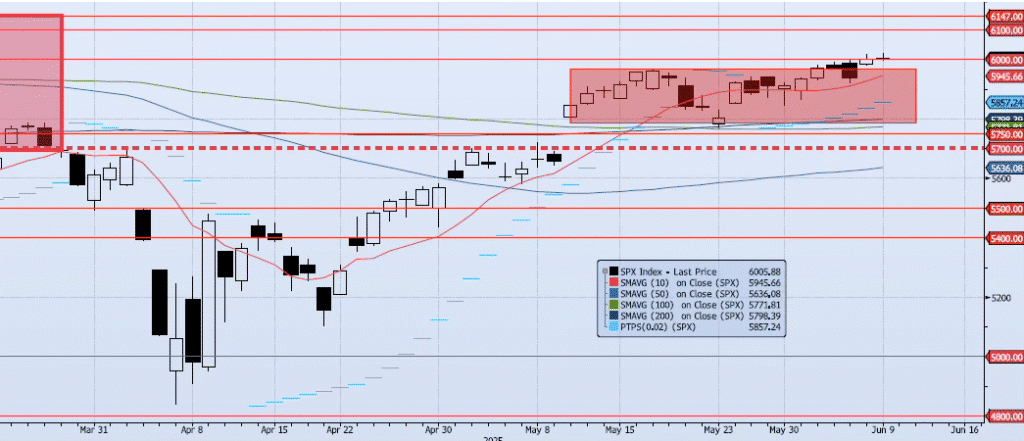

Current ACAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 1)

The SPX index gained 9bps yesterday, closing at 6005. This was the highest close since the index bottomed 24% lower on Apr 7 (ref 4835 low). Momentum and trend indicators remain divergent and are flat to negative. My Spot VIX and VIX Term structure signals are “risk on”. The ACAP Momentum/Trend Model signal has shifted to Neutral. All said, I have removed all SPX exposure and am waiting patiently for a more uniform signal/trade. The close yesterday above 6000 was certainly bullish, but I will remain cautious until market internals and my ACAP signal line up.

Trade Support:

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6000: Previous Support

6100: Previous Support

6147: All-Time High