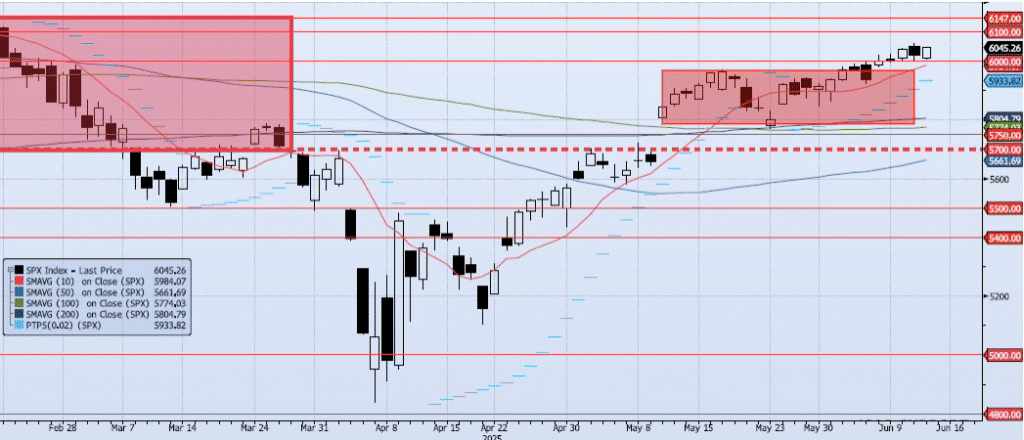

Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 1)

The SPX index gained 39bps during yesterday’s session, closing at 6045. As I have continued to highlight over the past two weeks, the growing/rotating negative divergence between price and momentum/trend has created an odd setup.

Additionally, my Spot VIX and VIX Term structure signals are “risk on”. Contradictory and churning for almost 10 sessions now. As I have continued to write, “I will remain cautious until market internals and my ACAP signal line up.”

To that point, as yesterday’s price action was positive, the ACAP Momentum/Trend Model signal shifted to Negative. This shift occurs on the close of the cash session at 4:15PM ET.

As unfortunate and heavy as the current headlines are, the model picked up on something and finally lined up with a signal that made sense. Risk is now clearly skewed to the downside with 5750 as a very attainable target.

Trade Support:

6000: Previous Support

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6100: Previous Support

6147: All-Time High