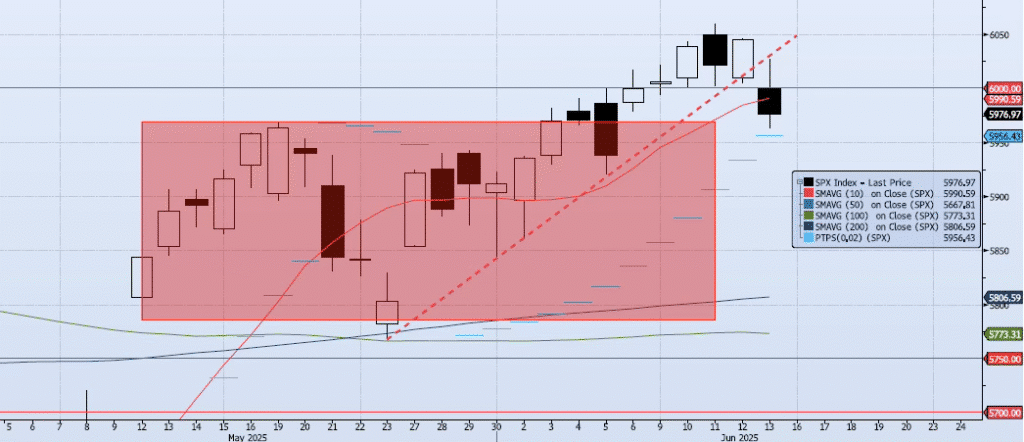

Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 2)

The SPX index lost 1.13% on Friday, closing at 5976. This close was just off the low of 5963 and was well bellow the 6000 level. The 6000 level has acted as stern resistance but looks to be failing as support, only lasted four sessions. My momentum and trend indicators have faded further. My Spot VIX signal remains “risk on” but my VIX Term structure signal is now “neutral”. The ACAP Momentum/Trend Model signal remains Negative. I believe risk is skewed to the downside for the near term with a reasonable target of 5750.

Trade Support:

6000: Previous Support (BROKEN)

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6100: Previous Support

6147: All-Time High