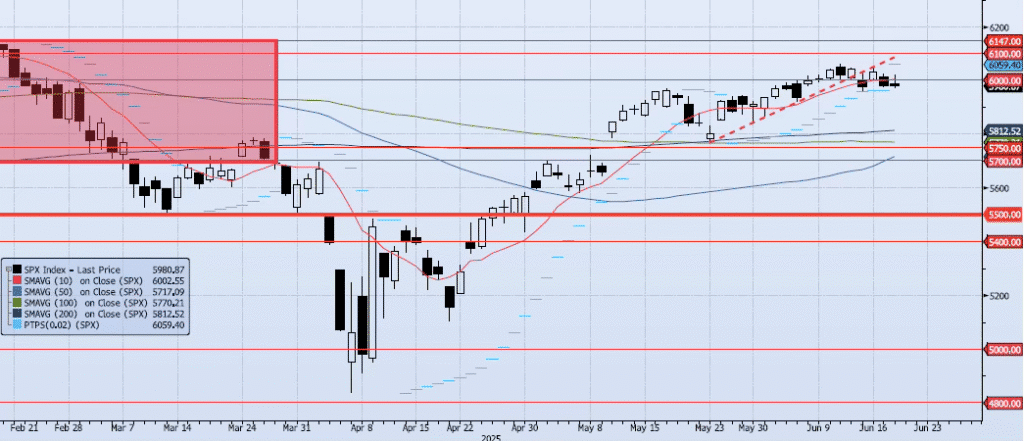

Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 5)

The SPX index lost a modest 3bps yesterday, closing at 5980. This close came at the lower end of the day’s broader, 1% high/low range of 6018/5971. The 6000 level has now failed to hold as support for three of the last four sessions as momentum and trend fade. My Spot VIX signal remains “risk on” but my VIX Term structure signal is “neutral”. The ACAP Momentum/Trend Model signal remains Negative. My overall opinion has not changed. As I wrote yesterday, “near-term risk remains skewed to the downside with 5750 a very reasonable target.”

Trade Support:

6000: Previous Support (BROKEN)

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6100: Previous Support

6147: All-Time High