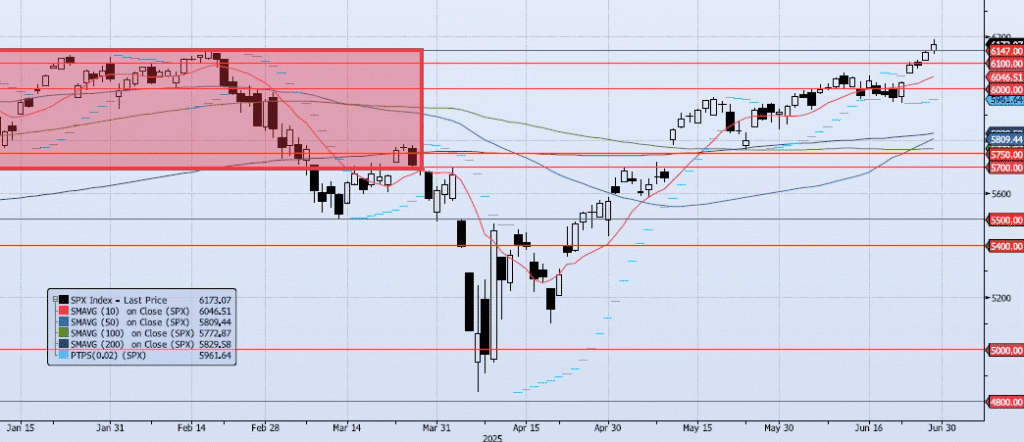

Current ACAP Momentum/Trend Model Signal: POSITIVE (Day Count = 2)

The SPX index gained 52bps during Friday’s session, closing at 6173. Not only did the index mark a new all-time closing high, but it also marked a new all-time intraday high at 6187. Last week was admittedly a bad one for a fund-raising trip, but let’s recap quickly. After a drawn-out Negative signal that essentially churned around 6000 for two weeks, the index was able to breakout above 6000 with a confirming signal shift to Positive. Headline risk aside, momentum and trend indicators are solidly confirming higher prices. My Spot VIX signal has shifted to “neutral” from a very productive “risk on” signal which triggered back on May 26. My VIX Term structure signal is “risk on”. The ACAP Momentum/Trend Model signal is Positive. All in, the index is breaking out in the face of some real underlying concerns. It would be foolish to fight what seems to be substantial upside risk.

Trade Support:

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6000: Previous Support (BROKEN)

6100: Previous Support (BROKEN)

6147: All-Time High (BROKEN)

6390: Fibonacci Projection (Aug ’22 Low to Feb ’24 High)