Current ACAP Momentum/Trend Model Signal: POSITIVE (Day Count = 7)

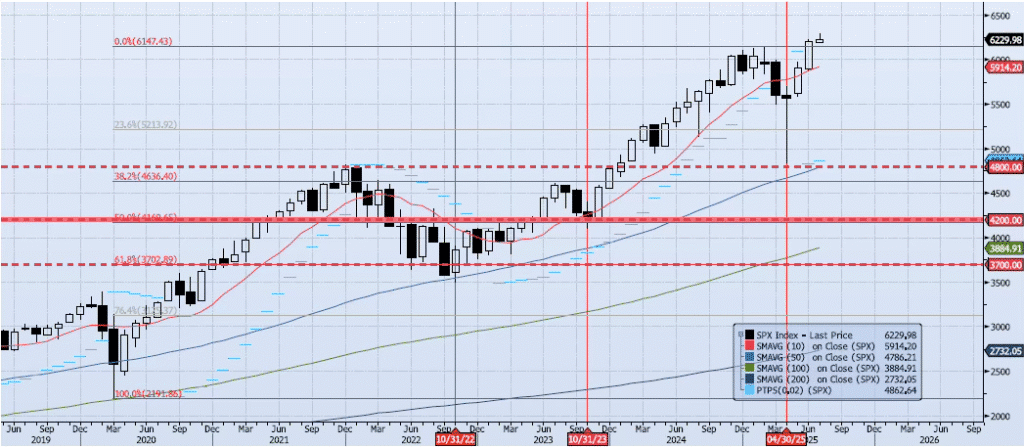

The SPX index lost 79bps on the day yesterday, closing at 6229. The low on the day was 6201, marking a two-day, peak-to-trough move of -1.33%. The hold at 6200 should be noted as a break and close below will signal a near-term shift in trend. As I wrote in yesterday’s note, “While there is some slight negative divergence developing, momentum and trend remain supportive of higher prices. My Spot VIX signal is “neutral”. My VIX Term Structure signal is “risk on”. The ACAP Momentum/Trend Model signal is Positive. I do have some concerns that this leg of the rally is extended but based on the current set up risk remains skewed to the upside.”

Trade Support:

6200: July 7 Low

6147: All-Time High

6100: Previous Support

6000: Previous Support

Trade Resistance:

6390: Fibonacci Projection (Aug ’22 Low to Feb ’24 High)