Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 6)

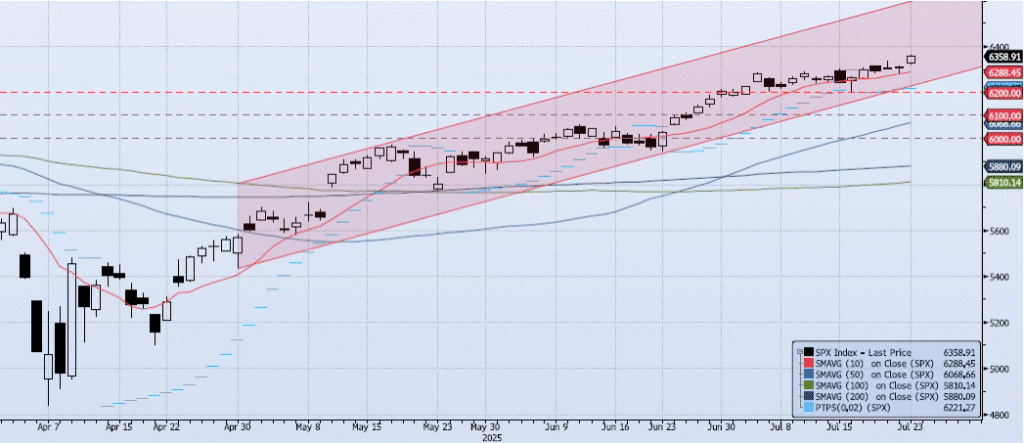

The SPX index gained 78bps on the day, closing at a new all-time high of 6358. The index was strong for the entire session as momentum and trend recovered slightly. My Spot VIX signal is “neutral”. My VIX Term Structure signal is “risk on”. The ACAP Momentum/Trend Model signal is Negative. As I have written over the past few weeks, the clear negative divergence and ACAP signal shifts suggest that risk is skewed to the downside. That’s said, I did write yesterday that “the index is screaming for a reason to test 6400 for the first time in history. I am sticking to the ACAP model and am positioned short here, but I have pared down exposure as this signal is not as clear as I would like.”

Trade Support:

6200: July 7 Low

6147: Previous All-Time High (Feb 19)

6100: Previous Support

6000: Previous Support

Trade Resistance:

6284: All-Time High (Jul 3) (BROKEN)

6390: Fibonacci Projection (Aug ’22 Low to Feb ’24 High)