Current ACAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 1)

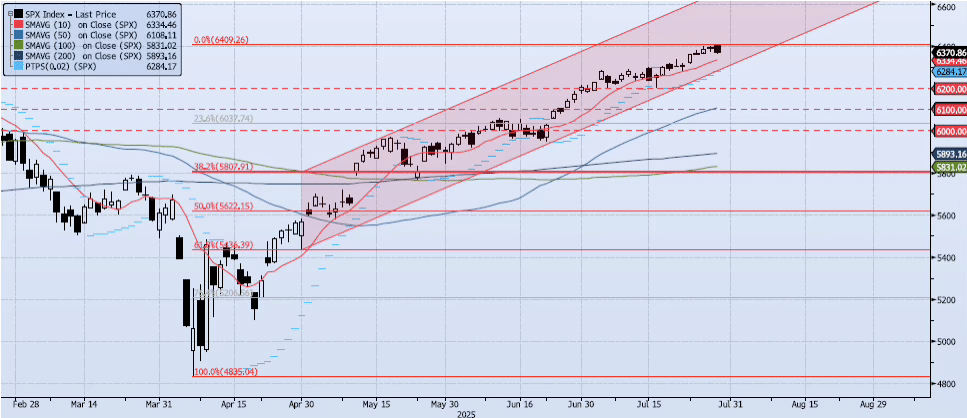

The SPX index lost 30bps during yesterday’s session, closing at 6370. The index hit a new all-time high (ref 6409) very early in the cash session and then struggled for the balance of the day.

Yesterday’s high/low/open/close (6409/6363/6405/6370) created a large, negative stick. This large, negative stick when viewed in combination with the previous day’s bar, forms a significant “bearish engulfing pattern”.

This pattern, while it needs to be confirmed in the coming days, occurred as my momentum and trend indicators struggled to expand. The ACAP Momentum/Trend Model signal shifted back to Neutral. As I wrote in yesterday’s note, “a breakout above 6400 would set up for a run to 6600. I do see this as the higher probability trade currently.”

That said, the index’s current inability to hold above 6400 as internals churn is concerning. This is a true neutral position with upside/downside risk evenly distributed.

Trade Support:

6200: July 7 Low

6147: Previous All-Time High (Feb 19)

6100: Previous Support

6000: Previous Support

Trade Resistance:

6284: All-Time High (Jul 3) (BROKEN)

6390: Fibonacci Projection (Aug ’22 Low to Feb ’24 High) (TESTED)

6400: July 28 All-Time High (TESTED)