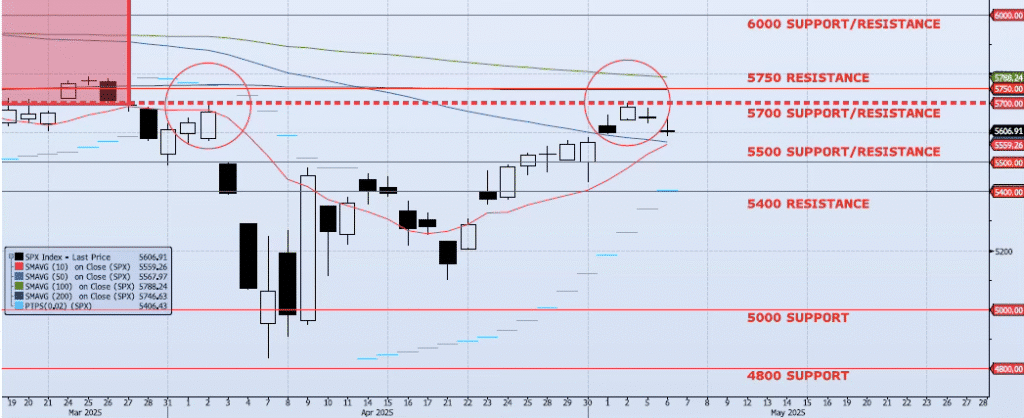

Current ICAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 1)

The SPX index fell 77bps on the session, closing at 5606. Since hitting its head at the previously identified resistance level of 5700, the index has had a three-day, peak-to-trough move of -2.01%. As I have noted over the past few days, momentum and trend indicators have continued to weaken even as price has pushed higher. This slightly negative divergence has picked up as my Spot VIX and VIX term structure signals remain mixed. The ICAP Momentum/Trend Model signal has shifted to Neutral. As I wrote yesterday, “I continue to respect the potential for a continuation of this recent counter trend rally. That said, I am becoming convinced that the 5700 level will hold and that the index will resume the fade to lower lows.”

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5567: 50dma (BROKEN)

5700: Previous Support Sep/Nov (TESTED)

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support