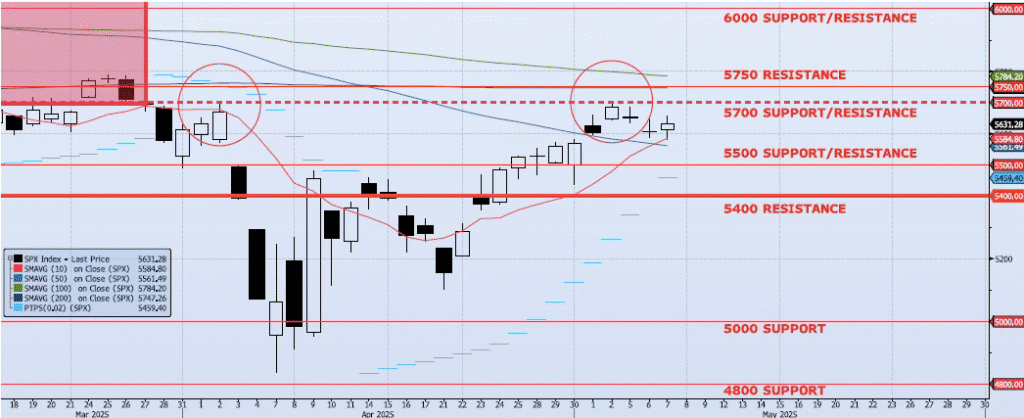

Current ICAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 2)

The SPX index gained 43bps yesterday, closing at 5631. Although breaking below on an intra-day basis, the 5600 level has continued to hold on a closing basis. The index is consolidating within the 5700/5600 range as momentum and trend indicators fade. My Spot VIX signal will shift from “risk on” to “flat” on the close and my VIX term structure signal remains neutral. I continue to believe that 5700 will act as significant resistance and that the index will resume its slide back towards the 5000 level in the near term.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5561: 50dma (BROKEN)

5700: Previous Support Sep/Nov (TESTED)

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support