Current ICAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 3)

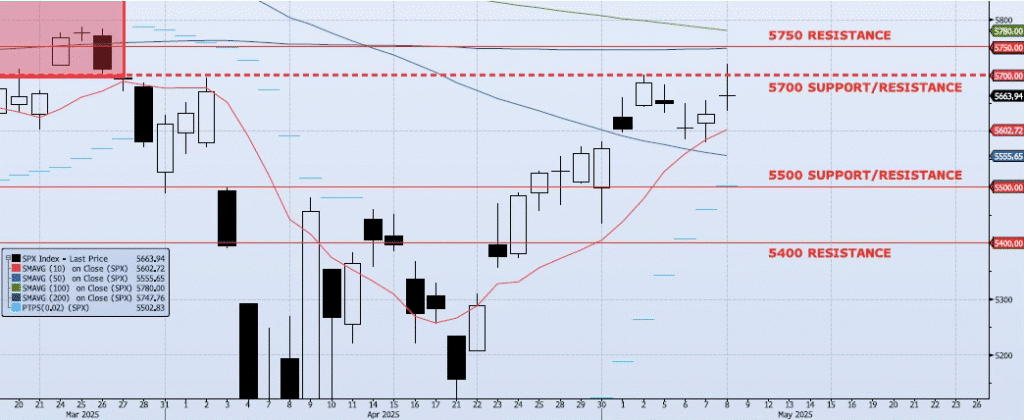

The SPX index gained 57bps on the day, closing at 5663. By mid-day the index had hit a high of 5720 but faded very abruptly in the final hour of the cash session (odd price action). The session was also marked by whip and indecision with a high/low spread of 85 handles and an open/close spread of less than one point. Long tails plus small bodies equal volatility and indecision. Momentum and trend indicators continue to fade. My Spot VIX signal is now “flat”, and my VIX term structure signal remains neutral. The ICAP Momentum/Trend Model signal remains Neutral. I continue to believe that 5700 will act as significant resistance (along with a horizontal 200dma at 5747) and that the index will resume its slide back towards the 5000 level in the near term.

Trade Support:

5000: ~20% Move Peak-to-Trough

4800: Dec 2021/Jan 2022 High

4200: ~50% Retracement Mar 2020 Low to Feb 2025 High

3700: ~Nov 2022 Low and 61.8% Retracement Mar 2020 Low to Feb 2025 High

Trade Resistance:

5400: Sep 2024 Lows and Apr 3 Low/Close (BROKEN)

5500: ~10% Move Peak-to-Trough (BROKEN)

5555: 50dma (BROKEN)

5700: Previous Support Sep/Nov (TESTED)

5750: 38.2% Retracement Peak-to-Trough

6000: Previous Support