Current ICAP Momentum/Trend Model Signal: POSITIVE (Day Count = 2)

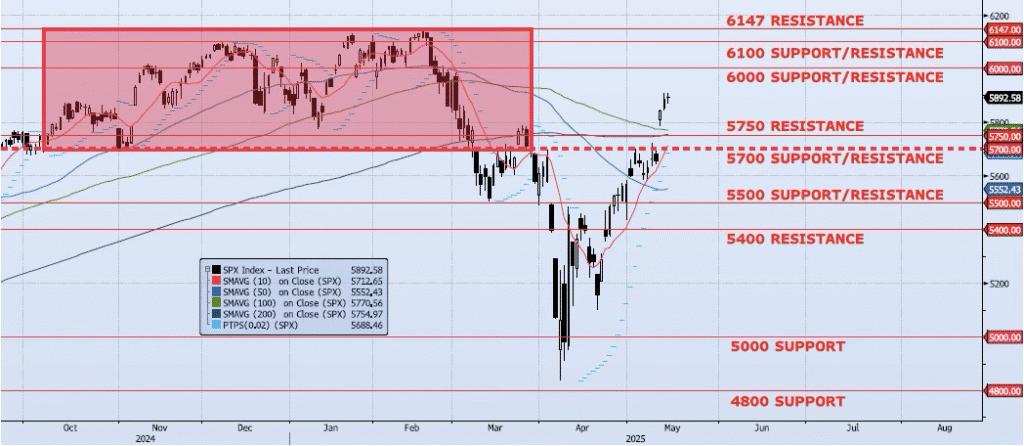

The SPX index gained just 10bps on the day, closing at 5892. The session high was 5906.55, just shy of the previous day’s high of 5906.64. Although internal expansion is slowing, momentum and trend indicators remain positive. My Spot VIX signal remains “flat”. My VIX term structure signal remains neutral. The ICAP Momentum/Trend Model signal is Positive. I would expect some consolidation at current levels if the index were going to make a true run at 6000. I would note, however, that such price action would need to hold above the May 12 low (ref 5786). If that level breaks, this recent gap up could develop into an “island reversal” which would create a significant drawdown. All said, the index seems poised to consolidate and test resistance at 6000 in the near term.

Note: I am in the process of changing fund structure and taking on additional capital. In the coming weeks Island Capital Investments LLC will become AscalonVI Capital LP. I will keep updates coming as far as official dates and changes. Thank you.

Trade Support:

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5552: 50dma

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6000: Previous Support

6100: Previous Support

6147: All-Time High