Current ACAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 2)

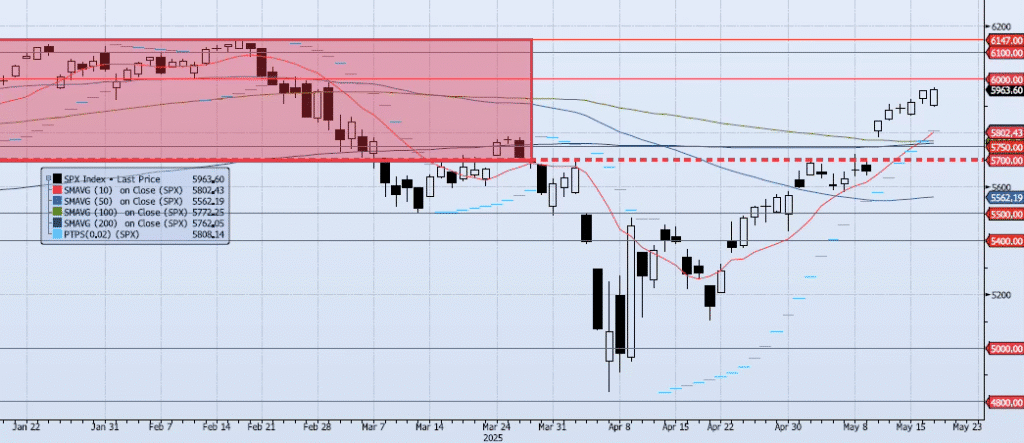

The SPX index opened down ~1% at 5902 and then rallied to close the session 8bps higher on the day at 5963. The early cash session weakness was quickly reversed as 5900 held as relatively firm support. Although the index doesn’t look ready to fade, internals continue to display negative divergence and would suggest that the risk of a reversal to the downside is growing. My momentum and trend indicators are flat to fading. My Spot VIX signal and VIX term structure signals are now “risk on”. The ACAP Momentum/Trend Model signal is Neutral. I am focused on a potential test of resistance at the 6000 level and support at 5786 (May 12 low).

Note: I am in the process of changing fund structure and taking on additional capital. In the coming weeks Island Capital Investments LLC will become AscalonVI Capital LP. I will keep updates coming as far as official dates and changes. Thank you.

Trade Support:

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6000: Previous Support

6100: Previous Support

6147: All-Time High