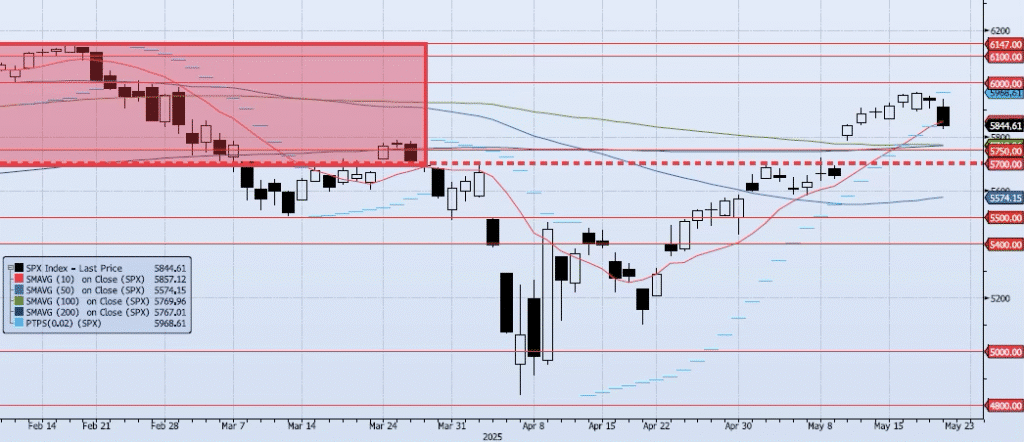

Current ACAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 4)

The SPX index fell 1.61% yesterday, closing at 5844. The session low (ref 5830) was 2.31% lower than the May 19 peak (ref 5968). As I have wrote on May 20, “internals continue to display negative divergence and would suggest that the risk of a reversal to the downside is growing.” We obviously caught some of that price action today. My momentum and trend indicators continue to degrade. My Spot VIX signal remains “risk on”. My VIX term structure signal is neutral. The ACAP Momentum/Trend Model signal remains Neutral. I am focused on resistance at the 6000 level and support at 5786 (May 12 low). A break below 5786 should produce an accelerated drawdown, filling the May 9/May 12 gap and a test of 5700.

Trade Support:

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6000: Previous Support

6100: Previous Support

6147: All-Time High