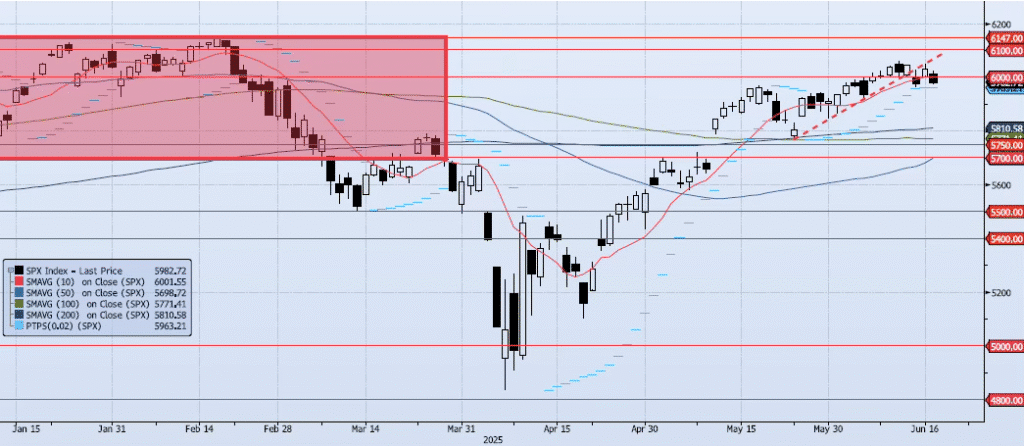

Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 4)

The SPX index lost 84bps yesterday, closing at 5982. Once again, the index continues to churn around the 6000 level (failing to hold) and remains below the highlighted short term trendline. I continue to see negative divergence between price and momentum/trend. My Spot VIX signal remains “risk on” but my VIX Term structure signal is “neutral”. The ACAP Momentum/Trend Model signal remains Negative. In my opinion, near-term risk remains skewed to the downside with 5750 a very reasonable target.

Trade Support:

6000: Previous Support (BROKEN)

5750: 38.2% Retracement Peak-to-Trough

5700: Previous Support Sep/Nov

5500: ~10% Move Peak-to-Trough

5400: Sep 2024 Lows and Apr 3 Low/Close

Trade Resistance:

6100: Previous Support

6147: All-Time High