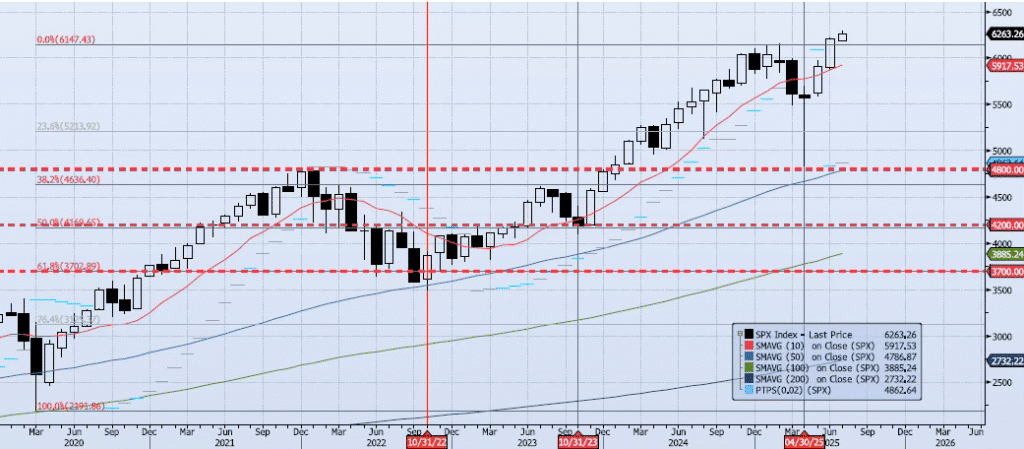

Current ACAP Momentum/Trend Model Signal: NEUTRAL (Day Count = 2)

The SPX index gained 61bps during yesterday’s session, closing at 6263. Despite this gain, my momentum and trend indicators continue to degrade and/or flatline. The slight negative divergence I have been noting over the past few days is continuing in a gradual and uniform fashion. My Spot VIX signal is “neutral”. My VIX Term Structure signal is “risk on”. The ACAP Momentum/Trend Model signal is Neutral. Overall, I do feel that this leg of the rally is extended and is losing steam. I am sticking to the Neutral call here and expect price to retrace to the downside in the near term.

Trade Support:

6200: July 7 Low

6147: Previous All-Time High (Feb 19)

6100: Previous Support

6000: Previous Support

Trade Resistance:

6284: All-Time High (Jul 3)

6390: Fibonacci Projection (Aug ’22 Low to Feb ’24 High)