Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 4)

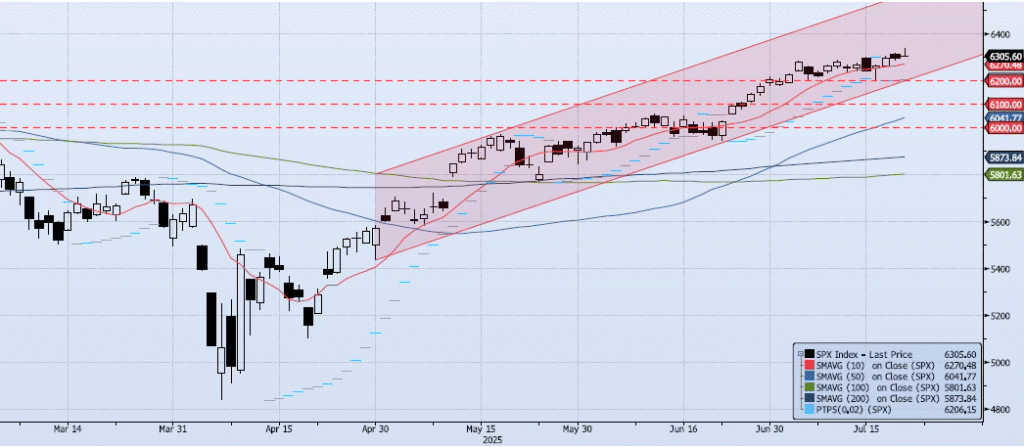

The SPX index gained a modest 14bps during Monday’s session, closing well off the high (ref 6336) at 6305. My momentum and trend indicators remain negative to flat. My Spot VIX signal is “neutral”. My VIX Term Structure signal is “risk on”. The ACAP Momentum/Trend Model signal is Negative. The current setup presents clear negative divergence between momentum/trend and price. I do see the potential for this divergence to resolve to the upside. However, the higher probability trade remains to the downside with a potential test of 6000 well within reason.

Trade Support:

6200: July 7 Low

6147: Previous All-Time High (Feb 19)

6100: Previous Support

6000: Previous Support

Trade Resistance:

6284: All-Time High (Jul 3) (BROKEN)

6390: Fibonacci Projection (Aug ’22 Low to Feb ’24 High)