Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 1)

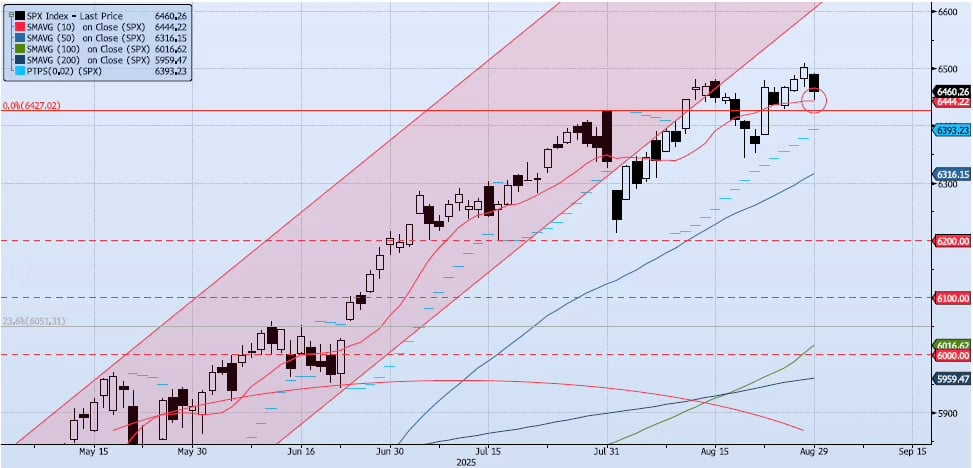

The SPX index lost 64bps during Friday’s session, closing at 6460. The 10dma (ref 6444) once again acted as firm short-term support as the index hit a low of 6444 and bounced. Momentum and trend indicators are struggling to break out and degraded on the session more than expected. My Spot VIX signal and VIX Term Structure signal remain “risk on”. However, my Spot VIX signal will flip to “neutral” on the September 3 close. The ACAP Momentum/Trend Model signal flipped back to Negative. Overall, price action is somewhat concerning as consolidation near all-time highs is beginning to feel like churning. The ACAP signal shift back to Negative was also unexpected and nullifies my previous stance of being a “buyer above 6400” for now. All things considered and under the current setup, I would be flat here but ready to get very short on a break below 6400.

Trade Support:

6400: Previous All-Time High (July 28)

6200: July 7 Low

6147: Previous All-Time High (Feb 19)

6100: Previous Support

6000: Previous Support

Trade Resistance:

6481: All-Time High (Aug 15)

6600: Mid-Point of Uptrend Channel