Current ACAP Momentum/Trend Model Signal: NEGATIVE (Day Count = 3)

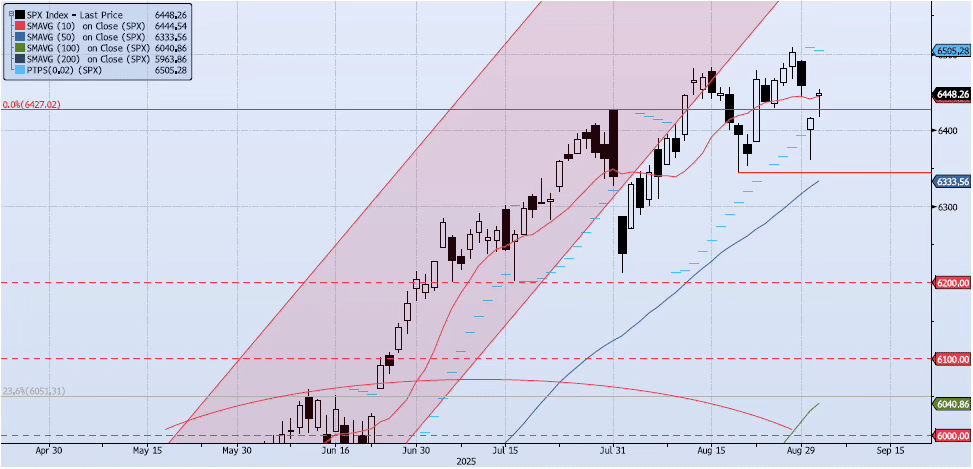

The SPX index gained 51bps on the session yesterday, closing back above the 10dma (ref 6444) at 6448. Momentum and trend indicators continue to degrade. My Spot VIX signal flipped back to “neutral”, returning +1.87% on the trade. My VIX Term Structure signal remains “risk on”. The ACAP Momentum/Trend Model signal remains Negative. I have continued to note over the past few sessions that, despite the Negative ACAP signal, price action seems relatively constructive. With that, I have been positioned flat (not short) but have reiterated my readiness to get short on a break below 6400. As a reminder, the ACAP process is not pure quant. It is a rule-based strategy which includes a unique tradeable universe, trade signals and portfolio weighting process. Within that process are windows where discretion is permitted. The reluctance to jump in short under the current set up is proving to be a net positive for performance.

Trade Support:

6400: Previous All-Time High (July 28)

6200: July 7 Low

6147: Previous All-Time High (Feb 19)

6100: Previous Support

6000: Previous Support

Trade Resistance:

6481: All-Time High (Aug 15)

6600: Mid-Point of Uptrend Channel